How Long Is It Okay For Parents To Financially Support Their Adult Children For?

Due to the pandemic and various economic factors, adult children are staying home longer than ever before, and are putting some parents in a financial bind, but the jury is still out on what age adult children should start paying their own way, with a consensus falling somewhere between 19 and 23 years old.

This article is more than 2 years old

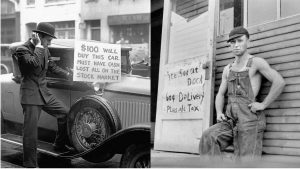

In September 2020, the Pew Research Center shared that 52 percent of young adults still lived at home with one or both parents. The article said that it was the largest number since the Great Depression and cited the coronavirus outbreak as the reason so many parents were still supporting adult children. Three years later, a new poll found that not only are over half of Generation Z adults still tucked safely inside the family nest, they also see little reason to fly away.

Unsurprisingly, Baby Boomer and Gen X parents and their Gen Z offspring disagree on when it’s okay to stop supporting adult children. According to a Bankrate survey of 2,346 US adults, Gen Z adults (between the ages of 18 and 26) think parents should extend grace over the age at which they’re expected to pay their own expenses. Besides housing, this includes car payments, cell phones, credit cards, health insurance, student loans, subscription services, and even travel.

Gen Z adults told Bankrate they shouldn’t have to start paying rent until age 23, on average, while their parents said they should start paying at 21. Gen Z respondents said they should start paying for their cell phones and credit cards around age 21, but their parents said age 19 would be better. Meanwhile, the parents are putting their own retirement and financial well-being at risk to continue supporting adult children.

The survey found that some parents had sacrificed their emergency savings, retirement funds, debt payoff, and other financial milestones to help their grown kids continue living at home. Supporting adult children caused 31 percent of parents to label their financial sacrifices as having a “significant” impact on their own financial health. Baby Boomers were less likely than Gen X parents to make significant sacrifices to support grown kids, however.

Most survey respondents said that the ages of 20 to 23 is the best time to expect young adults to become self-sufficient and pay their own bills. Baby Boomers said 19 was a more reasonable age to expect their kids to pay their credit card bills and car insurance. That generation extended a bit more grace on housing, saying that 21 was a reasonable age to pay for one’s own housing.

Ted Rossman, a senior industry analyst at Bankrate, said that Gen Z adults may be guilty of self-serving behavior, thinking there’s no harm in staying on the family cell phone plan for another year or having Mom and Dad pay their car insurance a little longer.

There are ways to strike a balance between fully supporting adult children and kicking them out of the house. First, parents need to take a realistic look at their own finances and how supporting adult children impacts them. It’s not wise to continue offering help when it means sabotaging a comfortable retirement.

Rossman also noted that supporting adult children should not be seen as an “indefinite handout” but as something with a specific dollar amount and timeframe.

It’s important to provide a timeline and expectations to help Gen Z adults prepare to leave the nest. The cost of living continues to rise, young adults are facing economic uncertainty when launching out onto their own. Therefore, their hesitancy to leave home is understandable, but parents cannot sabotage their own financial health to continue supporting adult children.

“It’s like the airlines say: Put your oxygen mask on before helping others,” Rossman said. “If a parent offers too much financial assistance, that could set them back and maybe even lead to asking their adult children for money down the line. There’s something potentially awkward and circular about that.”